-

We offer a variety of convenient billing and payment options, including Average Billing, Paperless Billing and Automatic Payment Options.

Account management FAQs

Account management FAQs

We offer a variety of convenient billing and payment options, including Average Billing, Paperless Billing and Automatic Payment Options.

You can log in to your account to pay, or you can pay without logging in on our Quick Pay page. To see your billing and payment history, you'll need to log in, and if you don't have an online account, you can create one in just a minute or two.

You can choose a billing option that’s right for you in your online account — receive your bill in the mail, via email notification or both.

You'll automatically receive an email every month when your bill is ready, which will contain a link to your online bill.

To see your current bill and your bill history:

You will be able to view all your past bills, download PDF versions of the bills or request a hard copy be mailed to you.

All online bills are in Adobe Reader (PDF) format.

No, you cannot download bill information in an .xlsx or .xml format. However, you can download usage and cost information based on monthly activity by going to your Usage History page, using the dropdown menus to view your data by month and clicking the "Download My Green Button Data (.xml)" or "Download data (.csv)" link under your usage chart.

We only accept credit or debit cards with the Discover, MasterCard, Visa or American Express logo that can be validated via AVS (address verification service) and CVV2 (Discover, MasterCard and Visa feature a 3-digit CVV2 number on the back of the card. American Express features a 4-digit CVV on the front of the card). Note: Debit cards from government assistance programs and certain gift cards or pre-paid cards may not be validated in the AVS service.

Yes. Go to My Account > Profile to enter your payment information. It will be available the next time you pay your bill.

To update the expiration date for a card NOT used for automatic credit card pay:

To update the expiration date for a card used for automatic credit card pay:

You can check the status of each payment by going to My Account > Bill > Payment History.

Your payment may not have gone through for one of several possible reasons:

Bank draft payments made online will be credited to your Reliant account shortly after the payment is made, unless the payment is scheduled for a future date.

A $25 returned payment charge will be assessed against your Reliant account if funds in your bank account are insufficient to cover the online payment.

To find out if you are eligible for a payment extension or a deferred payment please call us at 1-866-222-7100.

Eligibility for an extension or deferred payment plan is based on your payment history.

You can cancel any payment up until the time it's credited to your account. Go to your Payment History page; if the payment is available for cancellation, it will have a 'Cancel' payment link next to it.

Yes. When you pay with a bank account, you can choose to schedule a payment up to one month in advance. Just go to the Bill page, choose the account (if necessary), and choose to pay your bill with a bank account. If your account is overdue, you'll need to make a payment on the next available payment date.

The amount due shown on the Web is more current and may reflect payments or charges made to your account that occurred since you were last billed.

Yes, we use 128-bit encryption to help ensure the confidentiality of information provided during Web transactions.

Your account number is located on your Reliant bill, at the top of each page.

Your ESID (electric service identifier) is a unique 17- or 22-digit number given to an electricity delivery point in the ERCOT market. In other words, it is a long number typically used to identify your electric meter. You may also see it written as ESI I.D.

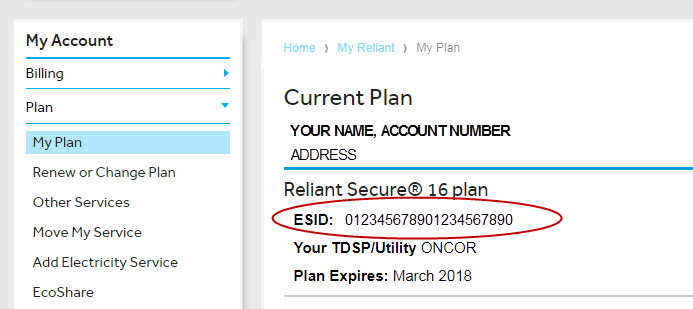

This number is often visible on your meter, but it also appears on your electric bill and in your online Reliant account. To find your ESID online:

esid

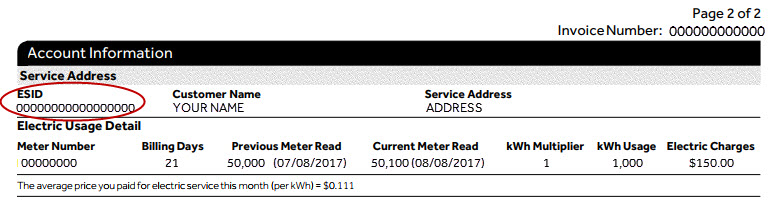

esid

On your bill, your ESID is located in the second Account Information section, usually on page 2. It should be on the left, next to your name.

No, only one email address can be designated to receive notifications from online account transactions.

Some of the more complicated preference changes may take a while to process and display on your account profile. You should see the changes before your next billing cycle.

You can relax knowing your bill will be paid for you every month, without lifting a finger. Plus, if you pay by credit card, you'll earn any reward points your card offers with each bill payment, like frequent flyer miles. You can also forget about writing checks, buying stamps, keeping track of due dates and incurring late fees.

Sign up online now by logging in to your Reliant account. It's quick and easy. You'll know the change has been implemented when your bill says “Do Not Pay” next to the current due information.

You can also download and complete an enrollment form, and fax it to the number listed on the form.

To set up automatic payments from a credit card:

Log in to your account, click the Update link, and choose the option to set up a new credit card.

To set up automatic payments from your bank account:

Log in to your account, click the Update link, choose the option to set up automatic payments from your bank account, then click Continue.

To update your existing automatic payment information:

Log in to your account, click the Update link and re-enter your automatic payment information as if you were setting it up for the first time. This will override your previous information.

By doing this, you will be removed from your previous automatic payment method.

To update the expiration date on your current credit card:

Log in to your account, click the Update link, choose the option to update your expiration date, then click Continue. You will then be prompted to update your information.

Log in to your account, click the Update link, select "Cancel automatic payments" then click Continue to confirm. If you prefer, you may call us at 713-207-7777 or 1-866-222-7100 to request a cancellation form.

You can also download and print either the Auto Bank Draft Cancellation form or the Auto Credit Card Cancellation form and fax it to the number indicated on the form. You'll know that the change has been implemented once the "Do Not Pay" no longer appears next to the amount due on your bill.

Signing up online is the quickest and easiest way. If you sign up by mail or fax, please allow 10 days after receipt to process your request. In all instances, please continue to make regular payments until you receive an invoice marked "Do Not Pay."

A $25 returned payment charge will be assessed against your Reliant account if funds in your bank account are insufficient to cover the online payment.

Average Monthly Billing allows you to pay an average amount every month instead of adapting to the highs and lows of seasonal bills.

First, we add your current usage charges to your last 12 months of usage charges (or the number of months available, if fewer than 12) for your service address. Then, we take that total and divide it by 12 months (or the total months available for your service address, if fewer than 12). Finally, we add 1/12 of your deferred balance credit or debit, which is the difference between your Average Monthly Billing amounts and your current actual usage charges. This calculation is redone every month, so your Average Monthly Billing amount on each bill will fluctuate slightly depending on your usage.

If there is no previous billing in your name at the service address, or you do not have 12 months of usage charges at the service address, we will take the previous usage at that service address and apply your current price to calculate your average monthly amount.

Each bill will show your Average Monthly Billing amount due that month, as well as your actual usage charges and deferred balance. The deferred balance may be a credit or a debit.

You can use the same payment options for your electricity bill payment as you would with regular billing. You can sign up for AutoPay to have the amount automatically paid each month, or you can pay by phone, by mail, through your online account or at a walk-up payment location near you. We accept credit/debit cards and checks.

Please call us at 1-866-222-7100 to cancel Average Monthly Billing. You cannot stop Average Monthly Billing online.

Any credit balance will be applied to your next bill or refunded to you; any outstanding deferred balance will be due at that time.

If you have less than 11 months of bill amounts at this service address, we will take the previous usage at the address and apply your current price to calculate your average monthly amount.

Any credit balance will be applied to your final bill or refunded to you; any outstanding deferred balance will be due at that time.

The deferred balance amount is the cumulative difference between your Average Monthly Billing amounts and your actual usage charges. The deferred balance amount can be found on your monthly bill. If the deferred balance amount is a credit, 1/12 will be subtracted from your Average Monthly Billing amount. If the deferred balance amount is a debit, 1/12 will be added to your Average Monthly Billing amount. If you’re a new Average Monthly Billing customer, the deferred balance will begin in the second month. Any owed deferred balance must be paid in full if you cancel Average Monthly Billing or terminate your account with us.

You may be eligible to have your deferred balance carried over to your new address. If you are eligible at the time you request a transfer of service, we will let you know.

With Paperless Billing, you no longer receive the payment coupon that comes with paper bills, and without this coupon, the processing of your check will be delayed. Therefore, we recommend that if you are set up for Paperless Billing, you always pay your bill online.

You can also set up your account for an automatic payment option, which will draft payments from your bank account or charge them to your credit card.

With Paperless Billing, you no longer receive a mailed bill that includes a payment coupon, and without this coupon, the processing of your check would be delayed. Therefore, we recommend that if you are set up for Paperless Billing, you always pay your bill online. You can also set up your account for an automatic payment option.

To print a copy of your online bill:

You have several convenient options for paying your bill:

We have several walk-up payment locations. Use our payment location finder to look up locations by address or zip code.